OI story:

Studied OI pattern from May 25th. OI went up in the phase from 290-330 and then 60%+ longs got squared off on Left Shoulder (350-330). Head (340-390) of was achieved with minimal OI addition and once it started falling from 380s OI has gone up 150%. Shorts galore!! But existence of shorts is good for fast moves.

Supports:

Trendline support @296-297. 289 POC from March 2009 in CASH market. 277 is VAL from march 2009.

What brokerages are saying?

Morgan Stanley: We see favorable risk-reward in OnMobile, underpinned by:

1) Leading position in the growing domestic value-added services (VAS) market;

2) increased global opportunities through agreements with Vodafone and Telefonica;

3) undervaluation – on P/E to two-year forward earnings growth, the stock trades at 0.7x. Our price target of Rs466 implies 24% upside from current levels.

IIFL: Not able to find the link but the target given by them is 477 for next 1 year

Recommendation from me: buy 1/3rd qty @295-300 and if it dips to 285 but next 1/3rd and buy the last 1/3rd qty above 314 - SL for 2/3rd qty bought 270. Below 270 next stop will be 250 for a double bottom. If you are very long term investor then hold on to the stock even if it falls below 270.

Recent quarter results:

OnMobile Global has announced its results for the quarter ended September 2010. It has reported net profit at Rs 25 crore as against Rs 11.5 crore, a growt of 117.4% on year-on-year basis (YoY).

Net sales shot up 37.9% to Rs 115 crore from Rs 83.4 crore (YoY).

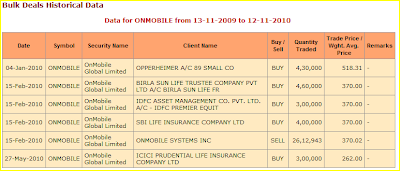

Who's buying this stock for last 1 year?

There was a stake sale by the management to SBI/IDFC/BIRLA SUNLIFE Insurance companies. And ICICI PRUDENTIAL amazingly bought it at almost lows during May fall to 4800s in Nifty!

No comments:

Post a Comment