Thursday, September 30, 2010

Options/futures data for 29th Sep (EOD)

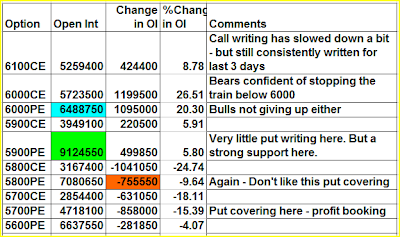

Summary:

1. Finally it looks like 6100CE writers have won the game. The addition of 33L puts we saw at 6100PE in first two days of this week was promptly reversed - 32L puts were unwound!

2. Action at 6000 was not any different. Massive call writing and put covering. The 6000PE which was getting covered for last 3 days and I kept on writing that "I don't like this put covering" - now we get the reason. Put writers were exactly wary of a fall happening just before the expiry.

3. So expiry looks to be closer to 6000 now. May be a 20-30 point range of 5970-6030 range depending on who has more muscle power whether 6000PE or 6000CE writers. My guess for 6030 on upside comes from the fact that yesterday 20L 60000CEs were added at average price of 34.

Nifty Futures:

SEP: 1.58Cr OI down 25% (54L shares cut)

OCT: 2.2Cr OI up 25% (45L shares added) -- OI still less than 3.8-4Cr in the middle of SEP series. We will know EOD what the final rollover number will be.

Banknifty Futures:

SEP: 11.6L OI down 20% (3L shares cut)

OCT: 12.9L OI up (4L shares added to OI) -- OI is still way less than the peak of 28-29L. We will know EOD.

Monthly Nifty Chart:

Wednesday, September 29, 2010

Options/futures data for 28th Sep (EOD)

Summary:

1. Options table is getting simpler. 6100 is the resistancewith 74L calls vs 53L puts. BUT, the most noticeable trend in last two days is relentless addition of 6100PEs. If it continues expiry closer to 6100 becomes a possibility.

2. Support at 6000 remains strong with 83L puts vs 52L calls. Looking at call covering at 6000, it does seem like expiry above 6000 is a very good possibility.

3. PCR has hit 1.98! The high PCR has almost capped the rise in this market until expiry.

Nifty Futures:

SEP: 2.1Cr OI down 16% (41L shares cut from OI)

OCT: 1.8Cr OI up 35% (47L shares added to OI) -- First time we have seen strong rollovers in Nifty.

Banknifty Futures:

SEP: 14L OI down 16% (2.8L shares cut from OI)

OCT: 8.7L OI up 34% (2.3L shares added to OI) -- Rollovers in Banknifty have picked up since last two days.

Tuesday, September 28, 2010

Options/futures data for 27th Sep (EOD)

Summary:

1. 6100 has finally proven to be the resistance as the call writers there seem to know what they are doing unlike call writers at the beginning of this month.

2. 6000 is still a decent support with 82L puts vs 53L calls. Although the intraday fall yesterday made a few put writers cover.

3. Quite a bit of calls were covered @5900 indicating that the expiry could be definitely higher than 5900. So the immediate range for Nifty is 6000-6100

4. PCR is at 1.94 and my yesterday's quote "with PCR so high, a serious rise from here is not possible pre-expiry" - is still valid.

Nifty futures:

SEP: 2.53 Cr OI down 18% (55L shares were cut) - The heaven sent gap up was used by longs to book profits.

OCT: 1.34Cr OI up 32% (32L added to OI) - 2/3rd were rolled over rest profit booked!

Banknifty Futures:

SEP: 17L OI down 6% (1.1L shares cut from OI)

OCT: 6.5L OI up 25% (1.3L shares added to OI) -- First time rollovers were decent. But still BN has had a lot of profit booking from its breakout point.

Monday, September 27, 2010

Options/futures data for 24st Sep (EOD)

1. With market making strong move above 6000, the action at 6000CE/PE was similar to action at 5900 a few days back. 6000PEs added 20L to OI and hence 6000 now becomes the support. Lets see if this level holds for expiry.

2. Calls covered across the board from 5800-6000. Only at 6100 very few calls were written. May be the fear of a Monday gap up. As of now 6100 is the resistance with 62L calls vs 20L puts.

3. Put covered started at 5900 now. Its been the feature of this market. As soon as the market takes one stop higher, lower levels puts start covering right away.

4. PCR is now at 1.93! Even though we have had very high PCR for last few days, the market has given only intra corrections of 70-90 points. But with PCR so high, a serious rise from here is not possible pre-expiry.

Nifty Futures:

SEP: 3.1Cr - OI down 6% (19.5L shares cut)

OCT: 1Cr - OI up 26% (21L shares added) -- First time in several days we had good rollovers.

Banknifty Futures:

SEP: 18.6L OI down 12% (2.5L shares cut) -- Banknifty OI is down 50% now from peak. Some rolled over to SEP but still a good amount was profit booking.

OCT: 5.9L OI up 32% (1.25L shares added)

Saturday, September 25, 2010

Thursday, September 23, 2010

Options/futures data for 23rd Sep (EOD)

Wednesday, September 22, 2010

Options/futures data for 21st Sep (EOD)

Summary:

Summary:Monday, September 20, 2010

Options/futures data for 20th Sep (EOD)

Options/futures data for 17th Sep (EOD)

Sunday, September 19, 2010

Friday, September 17, 2010

S&P500 fake move above 1130 today screwed all world markets!

Options/futures data for 16th Sep (EOD)

Wednesday, September 15, 2010

Options/futures data for 15th Sep (EOD)

Tuesday, September 14, 2010

Options/futures data for 13th Sep (EOD)

1. This breakout has been an call options writers' "nightmare" for sure. For those who had made it habit of writing calls as a "free money collection" method last few months - this month has been a pay out time with interest!

1. This breakout has been an call options writers' "nightmare" for sure. For those who had made it habit of writing calls as a "free money collection" method last few months - this month has been a pay out time with interest!

Sunday, September 12, 2010

Options/futures data for 9th Sep (EOD)

Friday, September 10, 2010

How come taking short trade seems more difficult than a going long?

Q: And you are sure that it’s not time to cut the shorts in telecom because Bharti has had a good run from Rs 260 to Rs 350?

A: That is basically, according to me, only ensuring my next years performance will also be good because I need some buffers for next year. It’s actually not Bharti per se, but the whole sector will become a bit of a joke with this sea of Etisalat coming into India and not appointing investment bankers, but only telling the press that he is interested in R COMM, no-no I am actually interested in Idea also, no-no I am interested in a third company. Where have we heard of a guy wanting to buy a company first announcing to the world that they are interested? I don’t know, maybe I have not tracked their stock, maybe they get a boost every time they say they are coming to India or even planning a visit. But it is unheard of for somebody to say upfront that you know I maybe interested in this company, so take it up 5% so that when I buy it, it becomes more expensive for me, stuff like that. So, I have, every day this kind of news coming in and we remain, it doesn’t matter, we are long short, we have to have something on the short side, so it doesn’t matter whether its telecom or commodity. It’s an intellectual business as much as actual returns and so we get intellectual satisfaction from some of the shorts. So, we will remain short.

May be if we approach the short trades as an "intellectual endeavor" it might take the burden of "doing good things" off the mind.

Saturday, September 4, 2010

Options/futures data for 3rd Sep (EOD)

2. Calls at 5500/5600 are still getting added with 5500 being the resistance now. But we wont stay in the 5400-5500 range for sure. Something has to give way next week.